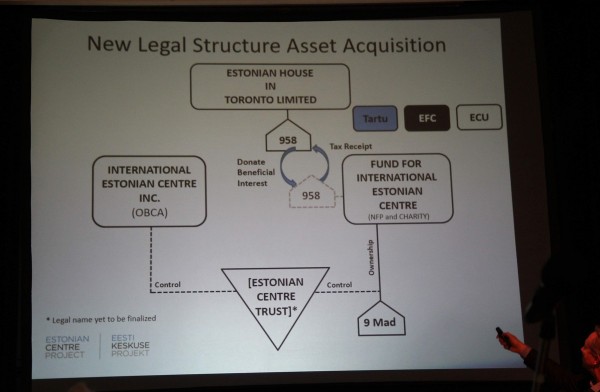

IEC is incorporated under the Business Corporations Act (Ontario). EH is its only shareholder. IEC took legal title to 9 Madison Avenue in trust for FIEC pursuant to a trust agreement. IEC will enter into construction contracts to build the Centre for FIEC. Once the Centre is opened, IEC will operate the Centre.

FIEC is incorporated under the Canada Not-for-profit Corporations Act. EH is its sole member. FIEC will accept donations which it will pass on to IEC in trust so that IEC can build and run the Centre. Upon receipt of charitable registration, FIEC issue tax receipts for tax deductible donations.

What will happen when the Estonian House sale to Revera closes?

Just prior to closing of the sale of 958 Broadview to Revera, EH will transfer the beneficial ownership of the property to FIEC so that the proceeds from the Broadview sale will accrue to FIEC. FIEC will issue a charitable donation tax receipt to EH which in turn mitigates capital gains tax consequences for EH. FIEC will pass those funds to IEC pursuant to the terms of the trust. FIEC will be the beneficial owner of 9 Madison and the improvements made on it, and will also hold the beneficial interest in 11 Madison, with IEC holding legal title, in trust for FIEC. 9 and 11 Madison will be merged into one parcel of real estate onto which the Centre will be built.

Advertisement / Reklaam

Advertisement / Reklaam

What of any mortgages against title?The Estonian (Toronto) Credit Union Limited (“ECU”) has registered a mortgage against 9 Madison Avenue to adhere to regulatory requirements to secure the monies advanced to IEC for the purchase of 9 Madison Avenue. Interest charges paid to ECU will be donated back to IEC. Estonian Foundation of Canada and Tartu College also advanced monies and may register on title in due course.

What does this mean for EH shareholders?

EH shareholders will continue to exercise their primary power which is to elect the directors of EH. The EH directors will appoint the directors of both IEC and FIEC, and thus EH will continue to control the Centre entirely.

https://www.estoniancentre.ca/...